Real-time payments are payments that are initiated, cleared and settled almost instantly. Their roll out around the world is gathering pace as financial institutions and businesses put in place the systems needed to meet growing demand for fast money movement, improved payment visibility and more efficient financial management.

“Push” vs “pull” payments

All payments can be catagorised as either “push” or “pull”. A push payment means the customer must actively push the money after a request from the recipient. Examples include direct bank transfers, card payments or even a cheque sent in the post.

On the other hand, with a pull payment, the recipient initiates the payment from the customer’s account, providing a pre-existing arrangement, or mandate, has been set up in advance. Pull payments can be more efficient, giving increased control to the recipient and more convenience to the customer.

In Australia the New Payments Platform is launching a new real-time pull payment service, PayTo, in 2022. It is an innovation that will allow businesses to initiate payments in real-time from their customers’ bank accounts.

To understand how real-time pull payments such as PayTo might work we can look overseas to where similar services have been launched recently.

India – paving the way for real-time payments

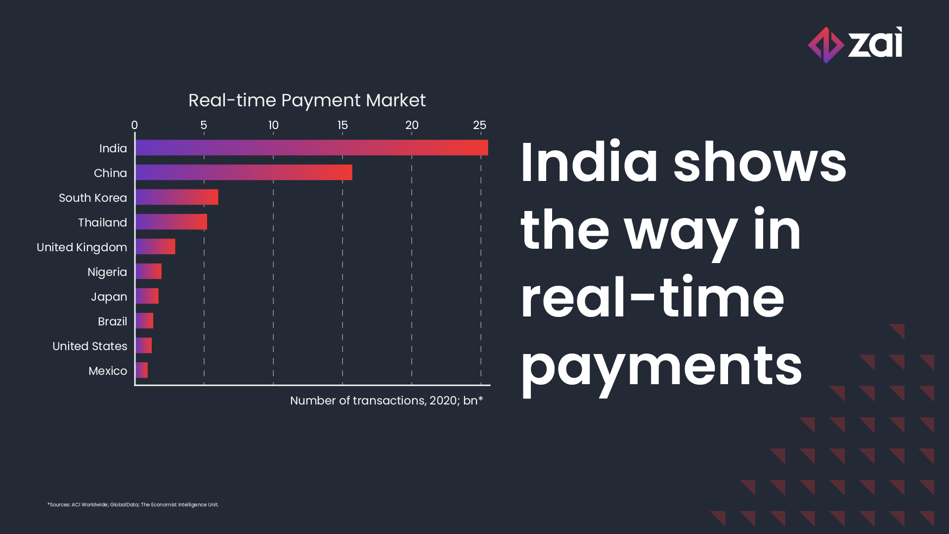

A report by the Economist Intelligence Unit (EIU) sees India showing the way in digital payments with more than 25 billion digital transactions in 2020, significantly ahead of China and South Korea who are in second and third place respectively. While the country is still largely rural, the pandemic has seen the use of digital payments, especially real-time payments, grow, both in volume and value, faster than anticipated.

India’s early effort, the Immediate Payment Service (IMPS) was launched in 2010 and is overseen by the National Payments Corporation of India (NPCI). Since then, the NPCI has facilitated real-time payments through the Unified Payments Interface (UPI), allowing multiple bank accounts to be accessed in a single mobile application, enabling seamless fund routing and merchant payments. Indian banks began uploading their UPI-enabled apps to the Google Play Store in 2016. Along with single click, two-factor authentication, a virtual address for customers meant pull and push payments could now be made without the customer having to input any account details.

Government institutions, such as the country’s central bank, encouraged uptake by providing the infrastructure needed, including QR codes for merchants and radio-frequency identification tags (RFID) for toll gates. This paved the way for the rapid uptake of real-time payments and the highest real-time transaction volumes in the world at 41 million per day in 2020.

Following the success of UPI in India, other countries followed suit. Brazil debuted its fast payment platform, Pix, in 2020, and Saudi Arabia unveiled its instant payment platform, Sarie, in early 2021. Just six months into its launch, the adoption of Pix by the Brazilian population has been extremely successful with 83 million individual users and more than 5.5 million companies on board. These are just two recent examples. Jurisdictions around the world are developing and improving their own real-time payment platforms and this activity has led to a global surge in real-time transactions, rising 41% in 2020.

Singapore - linking real-time payment systems

Singapore is another innovator in real-time payments with its two digital payment platforms known as Fast And Secure Transactions (FAST) and PayNow. Regular interbank transfers could take up to three working days to complete before a partnership with Mastercard company, Vocalink, was created to make instant payments a reality. With the introduction of FAST in March 2014 – modelled on the UK’s Faster Payment service - 24 banks and five non-financial institutions now offer real-time payments.

Other initiatives in Singapore are building further on this success. In May 2021, its central bank, the Monetary Authority of Singapore (MAS), announced a partnership between Thailand’s PromptPay system and the country’s PayNow platform - the first linkage of real-time platforms in two different jurisdictions, allowing the transfer of funds between the two countries. Following that, in September 2021, the PayNow system partnered with India’s UPI platform to allow the same. And in November 2021, the central banks for Singapore and the Philippines announced they would connect their own real-time and QR payments systems to allow instant, low-cost, cross-border payments. A similar partnership with Malaysia’s DuitNow system and Singapore is set to be rolled out between September and December 2022.

As digital payments continue to grow globally, financial institutions will offer improved services to businesses and consumers including more convenient and efficient ways to pay. At the same time, real-time payments are creating new consumer behaviours and spending patterns. Consumers no longer have to wait for funds to become available in order to spend and more are willing to pay a fee to access real-time transactions.

All types of businesses can benefit from these changes. Companies that embrace new technologies powering this shift will thrive and with PayTo looming on the horizon, a significant opportunity exists for both businesses and consumers to be at the cutting edge of the real-time payments revolution in Australia.

You can find out more about Australia’s new real-time payment service, PayTo, here.

PayTo is expected to roll out from mid-2022 onwards and Zai, as a payment initiator, will deliver a suite of best-in-class solutions including the management of mandates and the ability to initiate payment requests across sectors such as proptech, crypto and remitters. This will allow businesses to plug seamlessly into the PayTo service, providing their customers with a revolutionary new way to manage their payment arrangements.