The Australian payments landscape is one of the most developed and sophisticated in the world but it is changing rapidly. According to the Australian Payments Network, “As digitisation accelerates, the industry is modernising messaging, systems, and infrastructure to ensure the payments system remains efficient and resilient into the future.” Read on to find out how payments are evolving so you can stay one step ahead of the trends.

All the indicators show that 2021 was a bumper year for digital payments and the coming years are expected to support that growth trajectory as consumers continue to move away from cash, shop more online and use person-to-person (P2P) transfers.

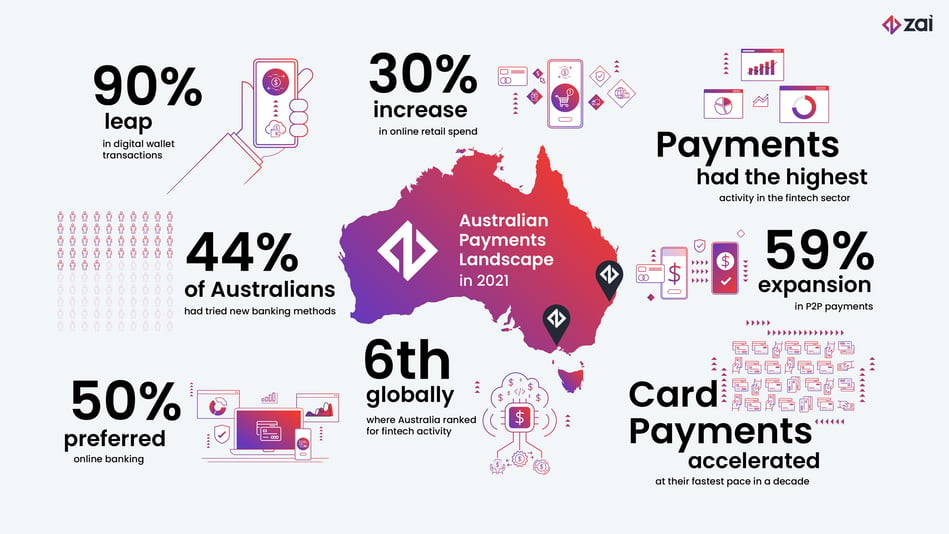

In 2021 the number of monthly digital wallet transactions were up 90% in the year to March while 44% of Australians had tried new banking mentors in the same period. Additionally 50% of Australians strongly preferred online banking.

In the 12 months to August 2021 online retail spend was up 29.8% to $50.74 billion with a record 5.9 million Australian households shopping online.

Elsewhere P2P payments were also on the rise, up 59% with 8.4 million PayIDs registered with the National Payment Platform Australia by September 2021.

Australia ranked sixth globally for fintech activity according to the 2021 Global Fintech Index by Findexable 2021 with the USA, UK and Israel, Singapore and Switzerland and the highest activity by the end of 2020 was in the payments sector according to KPMG.

GlobalData’s Payment Cards Analytics report from August 2021, the value of card payments is forecasted to register a compound annual growth rate (CAGR) of 6.6% between 2021 and 2025 to reach $967.9bn in 2025.

While physical cards are experiencing a boom, so too are other forms of electronic payment including mobile wallets with stored debit and credit cards. The Commonwealth Bank reports that over 40% of the bank’s debit and credit card contactless transactions were made via mobile wallets as of March 2021.

Sowmya Kulkarni, Senior Payments Analyst at GlobalData, said,

“Australia has a developed card payment market with a strong payment infrastructure and high consumer preference for electronic payments. Australians are prolific users of payment cards, with a high frequency of card payments at 185 times per card in 2020.''

“While the card payments market was affected in the short-run due to the pandemic, it is expected to rebound and continue its growth trajectory from 2021.

“While the COVID-19 pandemic hampered the growth of payments market in the short-run in Australia, it is expected to grow at a robust pace over the next four years, supported by the gradual economic recovery, a rise in consumer and commercial spending and high contactless adoption.”

Cards

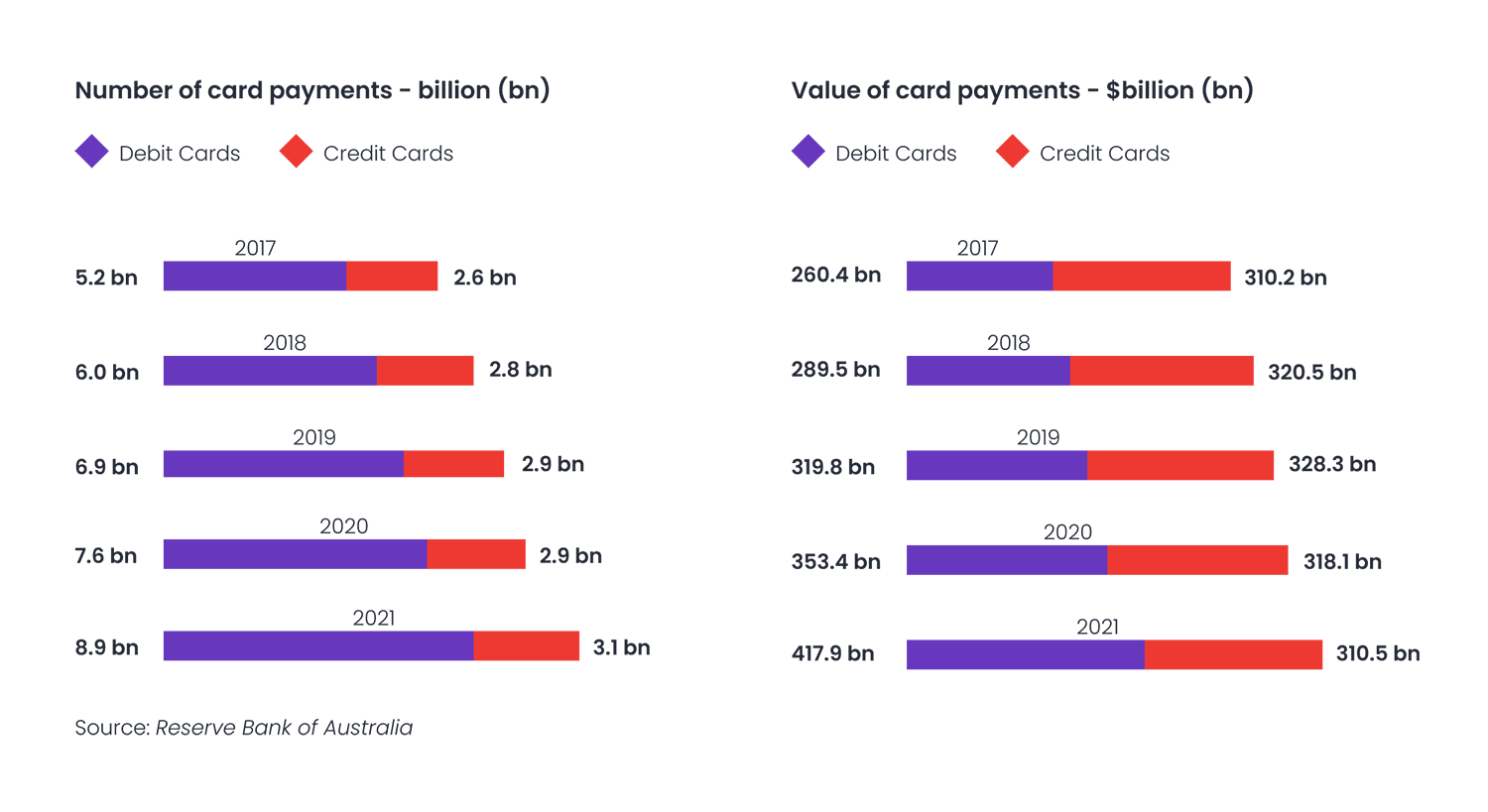

In 2021, card payments grew at their fastest rate in 10 years, in both transaction volume and value. There were over 11.9 billion consumer card payments, an increase of 13.1% on 2020. In terms of value, card payments grew 8.5% to $728.3 billion, driven by debit card payments, which saw transactions leap 16.3% in volume and jump 18.2% in value. However, credit card payments fell by 2.4% in terms of transaction value, but were up 5.0% by volume.

The total number of payment cards has remained stable in recent years at around 70 million. Cash functionality has remained a consistent feature, available on all cards, while debit and credit functionality have declined by 12% and 21% respectively between 2017 and 2020. Electronic money functionality continues to grow rapidly.

ATMS and POS devices

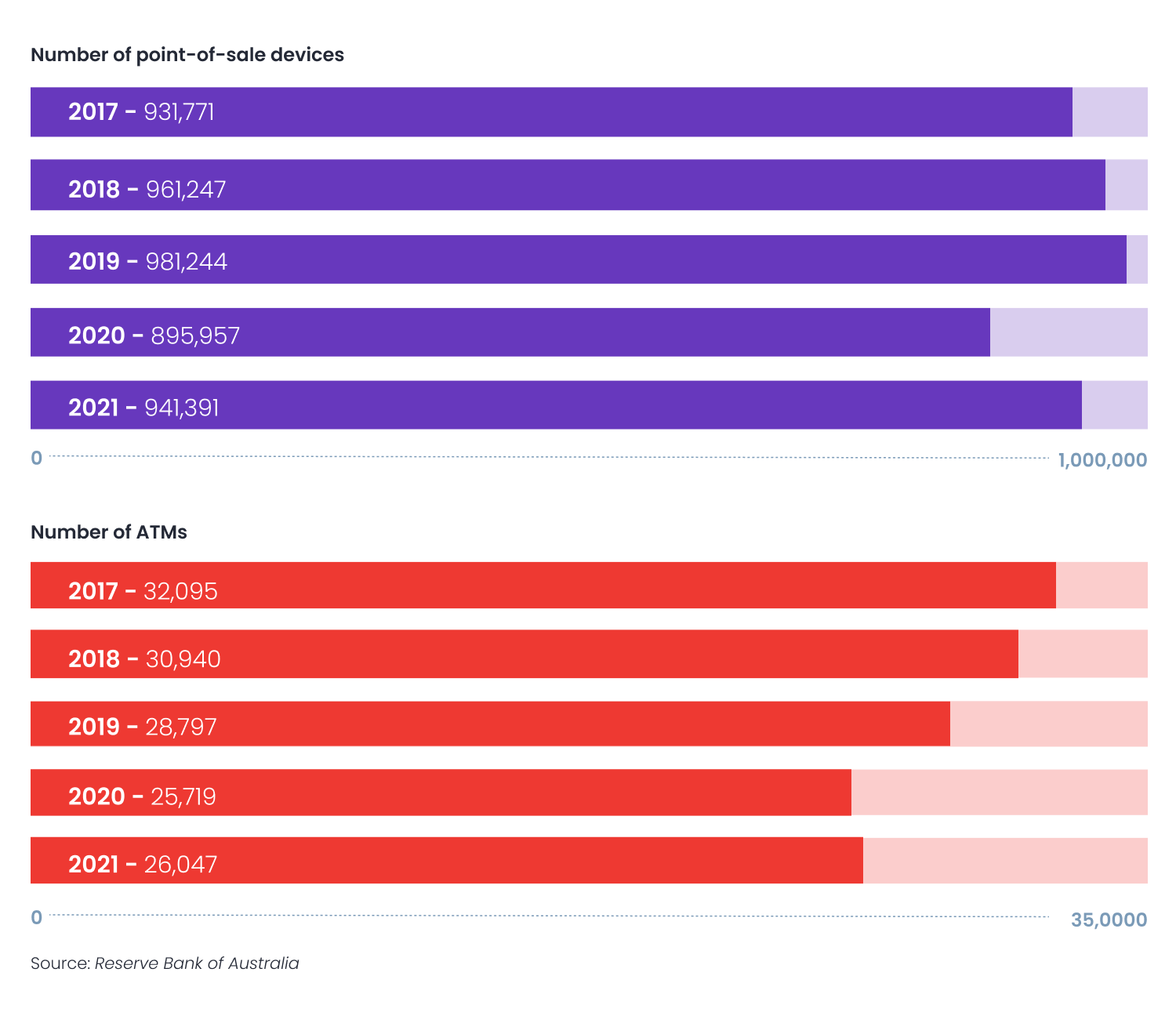

The number of POS terminals in Australia was up 5% to 941,391 in the year to June 2021, following an 8.7% drop in the previous year to June 2020. The growth can be partially attributed to merchants re-opening businesses after initial closures and lockdowns at the beginning of the pandemic in the first quarter of 2020. The number of ATMs also increased marginally by 1.2% to 26,047 as cash use for everyday purchases contracted.

Direct Entry

The direct entry system carries the majority of consumer payments by value, transaction volumes have been contracting. One driver could be traffic transitioning to newer payment systems like the National Payments Platform. The number of direct credits fell by 2.6% in 2021, while direct debits fell marginally by 0.4%. In terms of value, direct credits were up 4.3% to $9.6 trillion and direct debits grew 3.8% to $3.7 trillion, suggesting the economy had weathered the pandemic well.

.png?width=1500&name=Cardpayments4%20(1).png)

Cash

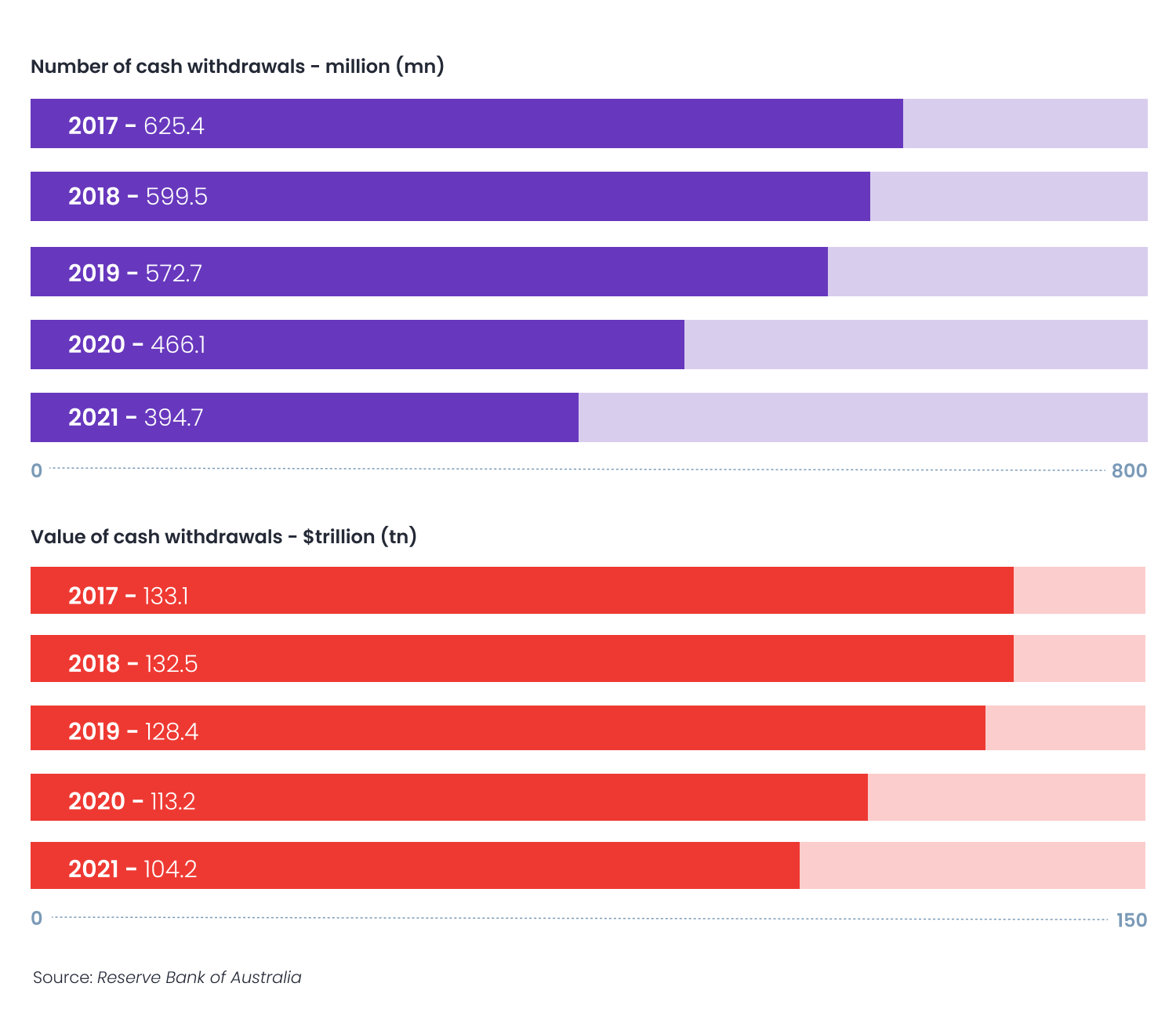

Cash use has been on the decline for 10 years and the pandemic has accelerated the trend. The value of cash withdrawals dropped 15.3% to $394.7 million, following a 18.6% drop in FY2020. Similarly, the value of ATM withdrawals fell by 8.0% to $104.2 billion, having declined 11.9% the previous year, supporting the notion that online shopping and cashless payments continue to eat into the old adage that “cash is king”.

Cheques

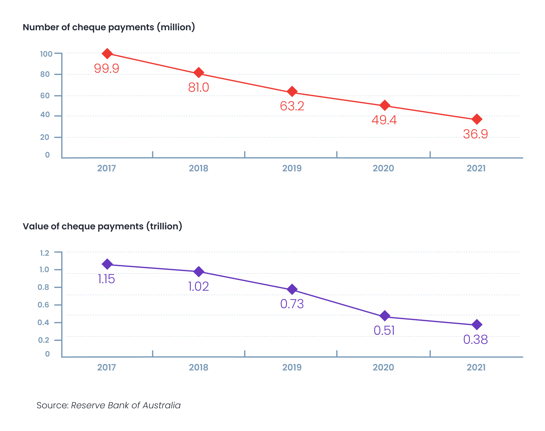

The trend away from traditional payment forms is even more extreme in relation to cheques. Cheque use collapsed 25.3% from 36.9 million in 2021, having fallen by an annual average rate of 21% between 2017 to 2020. The value of cheques dropped by 26.1% to $377.4 billion in 2021, in the wake of a record 29.8% decrease in 2020. Cheques are now estimated to account for under 0.2% of all consumer payments.

Card fraud

A total of $490.1 million was fraudulently transacted on cards in Australia in the 12 months to 30 June 2021, up 9.2% on full year 2020.

This breaks down as:

- Card-not-present (CNP) fraud - an increase of 12.3% to $442.0 million.

- Lost and stolen fraud - down 9.2% to $28.0 million.

- Counterfeit/skimming fraud - a decrease of 37.3% to $8.9 million.

The total amount spent on cards reached $847.3 billion during the year to end June 2021, meaning the overall fraud rate was 57.8 cents per $1,000 – up from 55.8 cents in 2020, but well below the 2018 figure of 73.8 cents.

The vast majority of fraudulent card transactions took place in Australia. Of these, 92% were “card not present” transactions, while 94% of overseas were card not present.

While the overall number of fraudulent card not present transactions in Australia is just 4% higher than overseas, the value lost to fraud is almost double in Australia when compared to overseas.

Despite fraudulent counterfeit/skimming transactions overseas being 14% lower than in Australia, the volume lost to fraud is 56% higher overseas than in Australia.

.png?width=211&name=Cover%20(6).png)