If you’re working with marketplaces, platforms and other exchanges, you’ll know that splitting payments manually can lead to numerous problems, including:

- Human errors, costing time, money, and business reputation.

- Processing delays, especially when trying to batch multiple payments together.

- Operational risks for parties involved.

- Trust issues when the split payments don't occur all at once.

- High costs, particularly when credit cards get involved.

Working with a split payments API helps solve many of the issues that come with manual split payments. In this article, we’ll explain how Zai’s split payments API works, its specific features and how to get started:

- How Zai's split payments API works

- Zai's split payments API features

- Float users

- E-wallets

- Multiple payment options

- Direct pay-outs with our partners' banking licenses

Note: looking to get started with Zai’s split payment API right away? Get in touch with one of our payment experts and we’ll get you set up.

How Zai's split payments API works

At Zai, we use payments automation to enable tech firms and companies set up flexible payment workflows that fit their specific business needs. For example, we can help a property management system set up a payment flow where payments are divided between landlords, agents and tradies.

Although we offer tools that individually offer low-cost and quick payments infrastructure, the real power comes from their ability to mix and match them, creating brand new possibilities – such as, setting up a custom payment workflow that also let's your customers pay with direct debits, BPAY and credit cards.

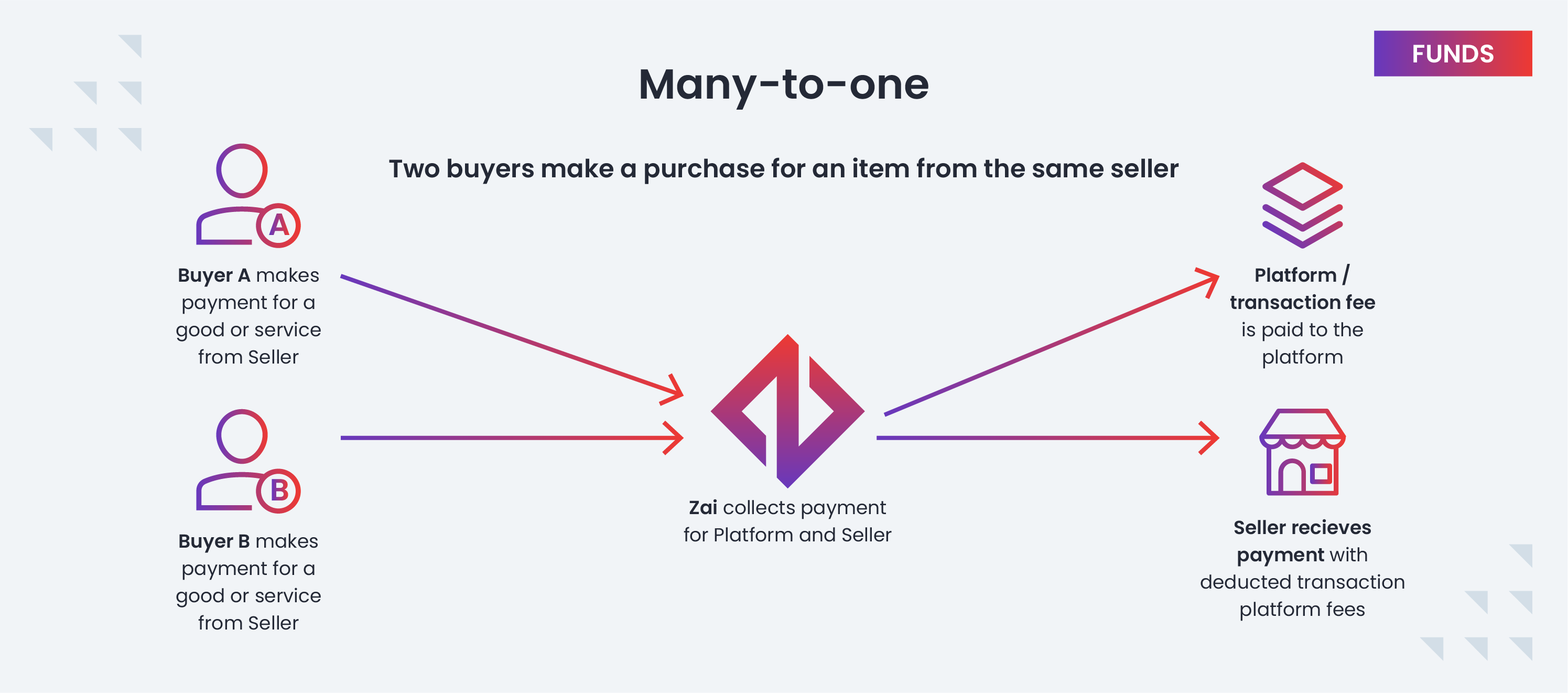

In many industries like proptech and marketplaces, money often has to be split up amongst various parties, usually divided into percentages.

At Zai, we use float users and e-wallets to enable automatic split payments to do the heavy lifting. To understand how Zai enables split payments let's look at the rental real estate sector, which is a classic example of an industry needing to split payments in order to offer a good customer experience.

How a property management system uses an API to manage split payments

Properties are complex businesses with multiple suppliers and obligations, including:

- Investors and landlords.

- Common utility payments such as lifts and hallway lighting.

- Insurance.

- Tradies and other service providers.

- Any other financial services obligations such as loan repayments.

Each of these providers has different payment terms, amounts, and due dates. Further, tenants come and go, with rents changing based on market conditions.

If you’re a manager trying to split each amount, you’ll often end up spending a lot of time calculating and executing payment requests. If you've ever been in the manager's seat (or even spoken to one handling these multiple payments), you know how quickly this process becomes overwhelming.

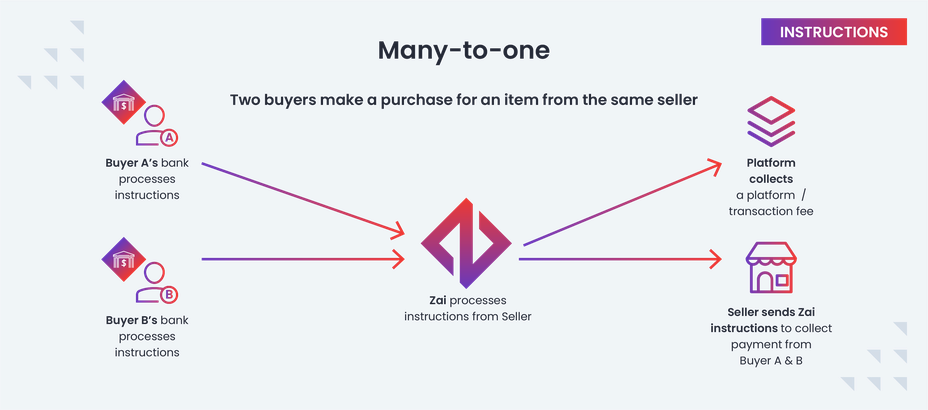

With Zai’s API, this becomes automatic:

- Once you’re set up and live with Zai’s API, you’ll be able to create a custom payment flow.

- Within the flow, you can assign each entity a user ID on both sides of the payment equation.

- Then each user, including the tenant and all the suppliers, gets a unique e-wallet (fully protected by Zai's banking license) which acts as a sub-account directly linked to the customer.

- Through Zai's dashboard or via an API request, you can set rules for how to split and pay each payment event, which we call an item.

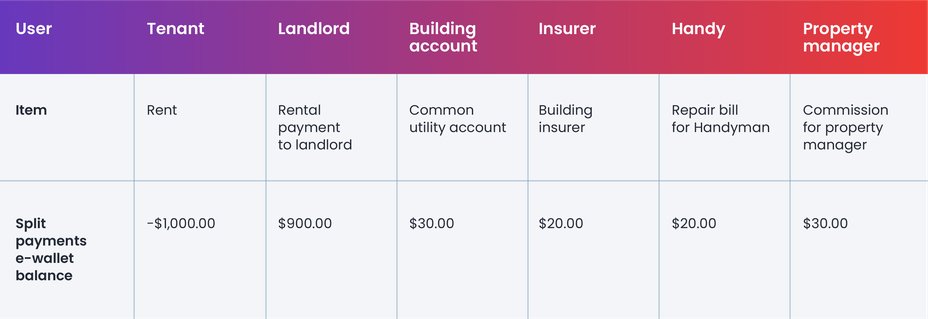

In this example, the property manager used an automated direct debit to pull $1,000 from the tenant and place it in that user's e-wallet. Then, the split payments API goes to work, splitting the rent payment and crediting it across multiple users.

5. Then, by the logic set in the system, the payments move both effortlessly and instantly between e-wallets.

Now, you can send the money in the wallet to the supplier's bank account, optionally taking your commercial pricing fee at the same time.

From the perspective of a property management system, the steps in Zai's split payments function look like this:

- Once onboarding is complete, the tenant, landlord, and other suppliers are set up as a user and e-wallet in Zai's system.

- Zai's direct debit or other payment method pulls the rent from the tenant into their wallet.

- Using the rules set by Zai's customers, the API then divides up the amounts owed to each supplier (the item) and moves those funds into their respective wallets. So here, the landlord would get their net rent payment, the property management company its commission, and the remaining utility and handy bills credited.

- Depending on who needs payment, and when the API will transfer the funds to the respective bank accounts. As Zai connects directly to multiple payment clearing systems, these transfers settle in 1 to 3 days.

You’ll just need to set the rules for each payment split, which you can do via a custom-built API dashboard.

Of course, the real estate rental sector isn't the only one to benefit from Zai's split payments API. We've seen use cases in marketplaces, online exchanges, and even B2B suppliers in the fast-moving consumer goods space apply our tools to great success

(Curious to learn more, and you're a bit technical-minded? Check out our docs, including workflow examples and wallet accounts).

Zai's split payment API features

Early on in our journey as a payment provider, we understood that our clients needed the flexibility to create customised split payment rules. Based on those learnings, we’ve built a wide range of easily-combinable features for bespoke solutions.

These features broadly fall into four categories: float users, storing deposits, mixed payment options, and direct transfer-out.

Float users to easily set up new users

Zai recognizes that businesses - particularly tech-minded ones geared for scaling - often don’t have the same recurring cast of clients (buyers) and providers (sellers).

Therefore, Zai's split payments make it easy to create and modify a user directly via the API. With as little as six parameters, you can quickly create a new user and underlying wallet in one API call.

The split payment API functions let clients rotate in and out 'cast members' based on the specific needs of the payments.

Taking our real estate example above, the property manager (hopefully) doesn't need to work with a tradie each month. Therefore, she can add him and the payment amount when she needs him and remove his user from the split when she doesn't.

E-wallets to instantly store payments

Zai also enables you to hold split payments in e-wallets. There are a few great reasons why this is so useful:

First, you can create an unlimited number of e-wallets directly via the API. Since the e-wallets are virtual sub-accounts to the main one, there's no hard limit on the amount available. Whether you need five or 5,000 e-wallets, Zai can set up as many as you need.

Since the e-wallets sit inside one master account, transfers between them are both free and instant. For consumer-facing businesses, instantly and freely moving money between virtual accounts can become a competitive advantage.

Second, there's no expiration date on the funds deposited in an e-wallet. Split payments usually don't happen all at once. Instead, payments go out in a set order of operations. How and when that happens depends on each supplier's terms. However, until that moment occurs, you can safely keep each payment amount in an e-wallet until the money is needed elsewhere.

Finally, Zai's e-wallets provide a welcomed layer of trust for users. Trusted central counterparties are crucial for multi-party industries like real estate and marketplaces. By holding funds on behalf of all users, Zai gives a layer of trust no branding on its own can provide.

B2B customers, in particular, appreciate the storing payments functionality. While we've already covered real estate, there are multiple use cases in consumer goods.

For example, a well-known coffee supplier sells their beans through grocery stores and boutique cafes. To help make deliveries move faster, the supplier gives each customer an e-wallet to pay orders instantly. Once the order hits the books, the supplier can automatically split the funds in the e-wallet to credit the delivery company, insurer, and bulk buying account.

Multiple payment options to cater to a wider customer base

Every company and consumer has their preferred payment method. Offering multiple payment options improves the payment experience and allows you to cater to a wider range of customers.

Zai natively supports

- Direct Debit (including ACH).

- The Australian electronic BPay bill payment system.

- Credit and debit cards.

- Real-time payments via NPP, including the soon-to-be-released PayTo protocol.

Perhaps more importantly, Zai's multiple payment options and banking licenses mean that you don't have to depend only on credit cards (and their high merchant fees) for pay-ins. By offering many card alternatives, you’ll save time and money while enhancing profits and user experience.

Since these connect via an API, developers can quickly deploy them to various front-ends. In theory, a Zai customer could create custom payment pages for each user, listing only that entity's preferred payment method.

Use Zai’s license to send outbound payments directly to users

In order to hold deposits and send payments to third parties, you need to have specific banking licenses.

That’s why many payment providers that offer split payments don’t allow direct payouts to third parties. It means that you often end up having to transfer the funds to a self-owned account and then make outward payments to the final beneficiary yourself.

At Zai, we have agreements with our banking partners that allows us to hold deposits and pay out to third parties directly from the platform. That means transactions settle faster and suppliers get paid sooner.

Zai's split payment API is the multi-payment solution your business needs

Zai's payments API enables marketplaces, platforms, and multi-party companies to set up custom complex payment workflows. With Zai, you can automatically split payments, manage users and pay-ins, hold funds securely, and send funds and a timely and regulated way.

Speak to Zai payment expert today to find out how to set up split payments for your company.