Australia has one of the most developed and advanced payment systems in the world, making it a country with a unique set of payment statistics and trends.

We’ve put together over 20 Australian payment statistics to help you better understand the payment landscape in Australia.

We’ve categorised it by:

Looking for a payment partner to help you set up custom payment workflows? Get in touch to learn more about how we can help you!

5 of the most interesting Australia payment statistics are:

-

One in four card payments in Australia are made with a mobile wallet (1)

-

99.5% of Australians have a bank account, and the average resident has 2.58 cards. (2)

-

As of November 2022, 114 Australian banks are sharing data via open banking with more than 30 different financial products. (3)

-

Australia has one of the highest use of POS devices in the world. (4)

-

The overall number of fraudulent CNP transactions in Australia is just 4% higher than overseas, however, the value lost to fraud is 56% higher in Australia when compared to other countries. (5)

An overview of the payment industry

The payment market in Australia has been forecasted to grow at a CAGR of 10.9% between 2022 and 2027, according to a Mordor report. (6)

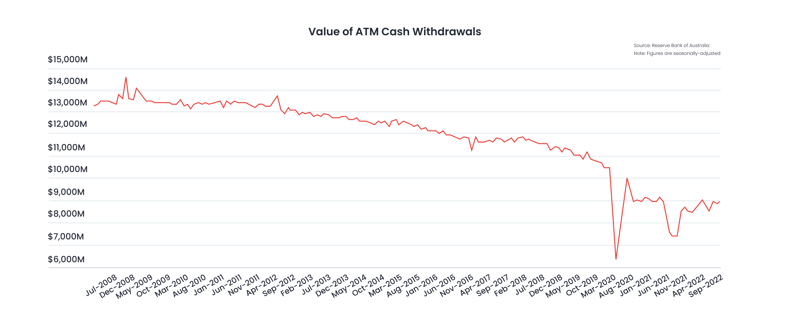

Cash usage has decreased by 30%, measured via the total value of ATM withdrawals. (6)

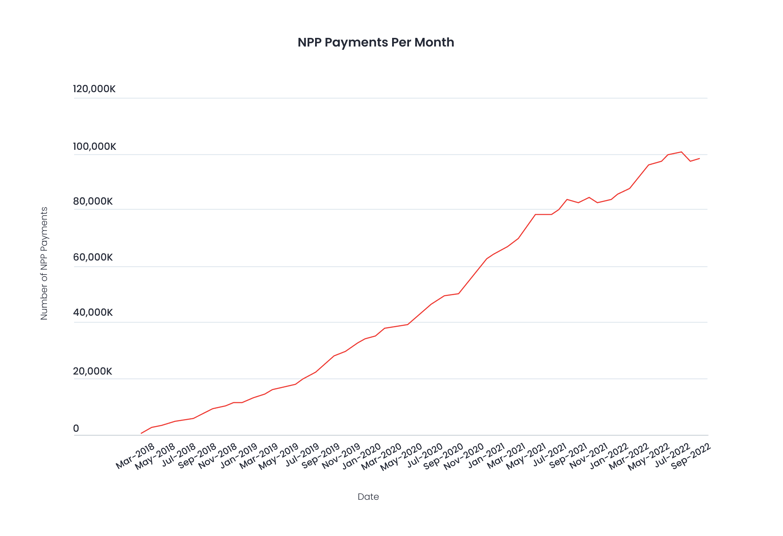

The New Payments Platform (the Australian payment rails that enable real-time payments) has over 72 million account holders. The NPP processes over 2 million payments every day, and they account for 25% of account-to-account credit transfers. (6)

The most popular payment method is debit cards, followed by credit cards and mobile wallets. (6)

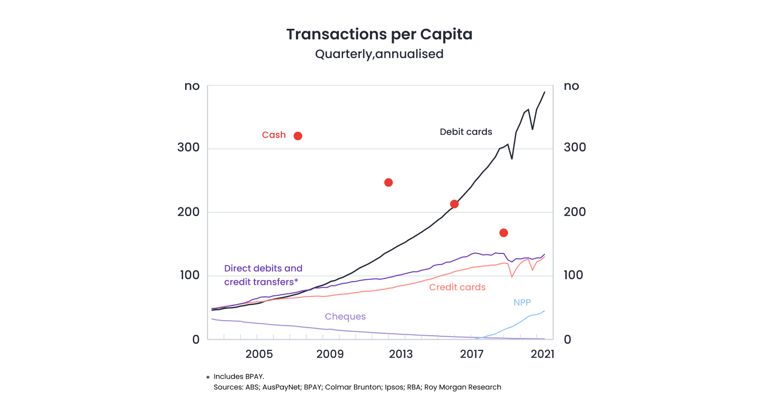

In 2020/21, Australians made 625 electronic transactions per person on average, compared to 275 per year a decade earlier. (7)

Payment method statistics

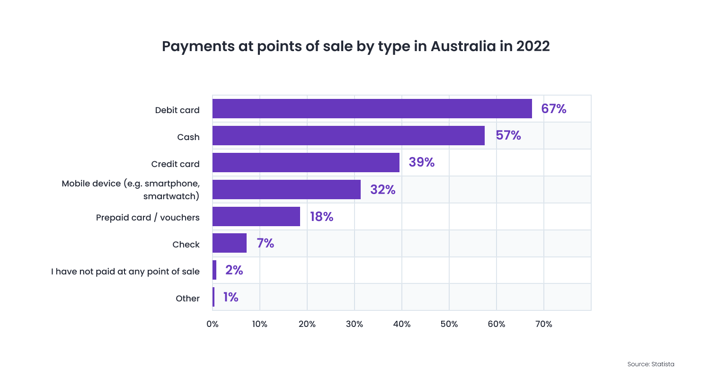

According to Statista, debit cards are the most popular payment method for payments at Point of Sale in 2022, followed by cash, credit card, mobile device, and prepaid cards.(8)

The majority of transactions in Australia are now made with electronic payment methods including physical and digital cards, as well as account-to-account transactions via the New Payments Platform. (7)

According to the Reserve Bank of Australia dataset, the number of direct credits fell by 2.6% in 2021, and direct debits fell by 0.4%. The value of direct credits were up 4.3% and direct debits up 3.8%, for a value of $3.7 trillion, indicating a recovery from the Covid pandemic. (9)

According to the RBA, here’s how cash, debit cards, credit cards, direct debits, cheques and payments via the NPP have progressed over time: (7)

Mobile wallets and mobile payments statistics

Electronic payments are seeing huge growth in 2022 and 2021. According to the Commonwealth Bank, more than 40% of the bank’s debit and credit transactions that were contactless were made with mobile wallets in March 2021. (10)

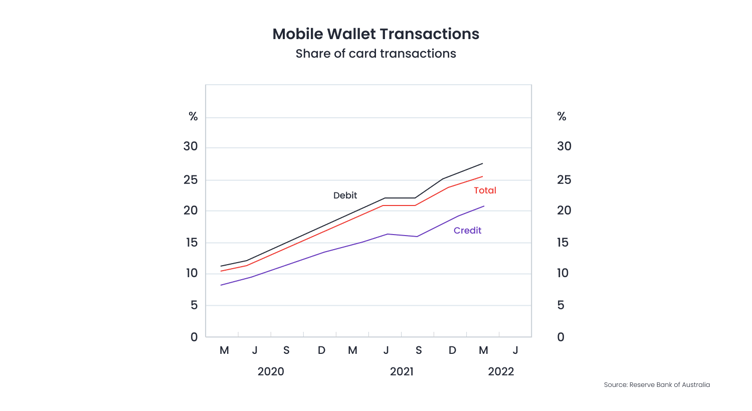

One in four card payments in Australia are made with a mobile wallet. (1)

In fact, in 2021, monthly digital wallet transactions were up 90%. According to the survey, 50% of Australians strongly prefer online banking (1).

A quarter of debit and credit card transactions are now made using a mobile wallet, up from 10% in March of 2022. Mobile wallet payments made with debit cards account for 27% of card payments compared with 21% for mobile credit card transactions.(11)

According to a survey by Marqeta, Australian consumers are using mobile wallets more frequently than consumers in the US or the UK. The survey shows that 69% of Australians feel secure enough using a mobile wallet to leave their physical wallet at home. (12)

Card payments

According to the GlobalData’s Payment Cards Analytics report from August 2021, card payments value is forecasted to reach a compound annual growth rate of 6.6% between 2021 and 2025, and to reach $967.9bn in 2025. (13)

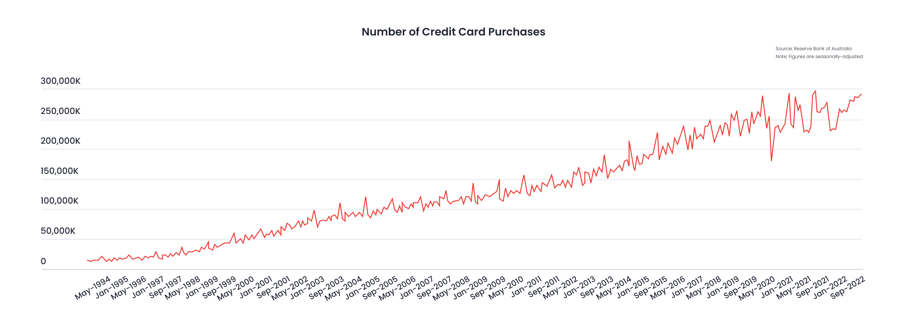

Australians used their cards 185 times in 2020. And in 2021, card payments grew in volume and value – the fastest rate in 10 years. During 2021, 11.9b consumer card payments took place, up by 13.1% in 2020. (13)

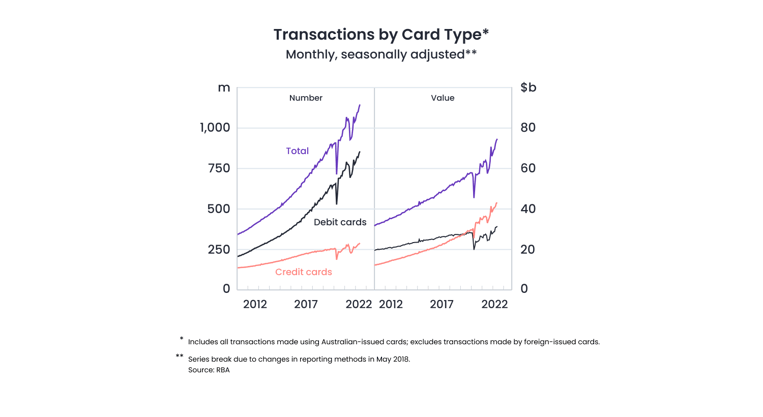

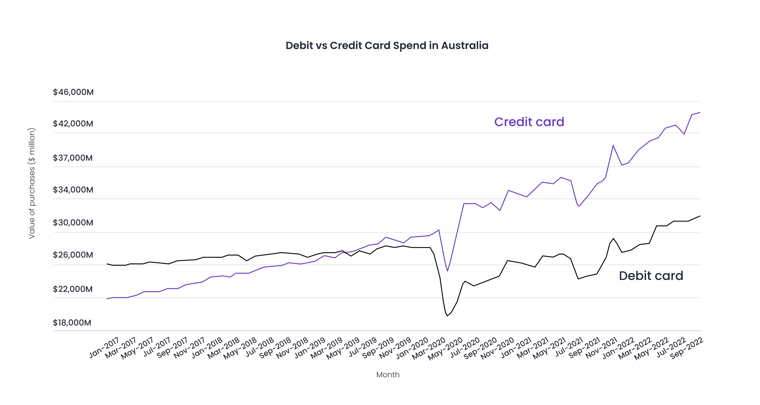

The value of card payments grew in 2021 by 8.5% to $728.3 billion, mostly driven by debit card payments, which grew by 16.3% in volume and 18.2% in value. Credit card payments, on the other hand, decreased by 2.4% in value, but went up 5% in volume. (13)

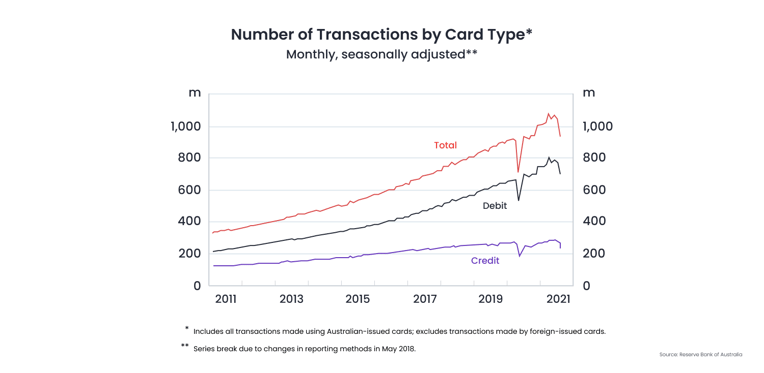

These are the number of transactions by card type over the years (7):

Interestingly, the graph for transaction number vs transaction value isn’t the same:

Cash payments

Like in many other developed countries, Australians have been using cash less and less for the past 10 years, with the pandemic speeding the trend up.

In 2021, the value of cash withdrawals decreased by 15.3% to $394.7 million. The value of ATM withdrawals also fell, by 8% to $104.2 billion. (14)

Banking and online banking statistics

According to AUS Banking, there are 97 banks in Australia, 4,491 bank branches and 7,757 ATMs. (15)

99.5% of Australians have a bank account, and the average resident has 2.58 cards. (16)

You may also like to read: Now that Volt Bank has closed, what are your options as an Australian fintech company?

Digital payments statistics for e-commerce

Between August 2020 and 2021, online retail spending was up 29.8%, reaching $50.74 billion and 5.9 million Australian households were shopping online. (17)

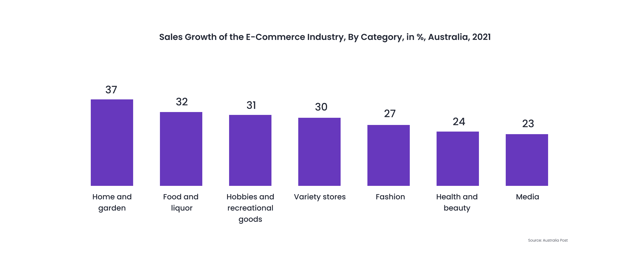

According to the Australia Post, the most popular categories for ecommerce in 2021 were home and garden, food and liquor and hobbies. (6)

According to the Australian Bureau of Statistics (ABS), in September 2021 the share of online sales in total reached 15.3% in Australia. (6)

PayID and NPP statistics

P2P consumer payments were also increasing, up 59% (17). 8.4 million PayIDs were registered with the National Payment Platform Australia by September 2021.

As of October 2021 (18), some of the most important NPP payments data are:

-

Over 105 financial institutions participate in the NPP.

-

There are over 75 million reachable accounts that can make or receive NPP payments.

-

There are 2.8 million average daily NPP transactions.

-

There are 8.7 million registered PayIDs.

-

There are $3 billion in average value of NPP payments every day.

-

NPP transactions take up 31% of all account-to-account credit payments.

-

The total cumulative value of NPP payments since launch is $2.6 trillion.

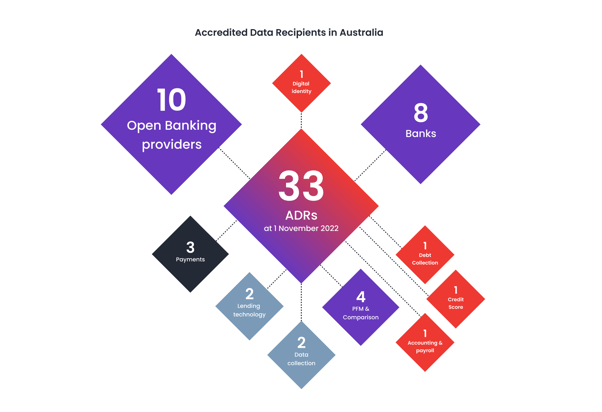

Open banking statistics

Open banking in Australia launched in July 2020. In 2021, it included savings accounts, credit card accounts, loan accounts, transaction accounts, and mortgages. (19)

16 banks representing 85% of Australia’s household deposits are active as data holders. As of 2021, 13 data recipients have been accredited for open banking, including fintech companies, accounting platforms, and comparison providers.

According to Frollo, a leading open banking provider in Australia, the number of fast and reliable data holders increased substantially in Q1 of 2022. 40% of banks score 99% or higher in terms of successful API calls, up from 22% in 2021. Additionally, they found that 49% of banks provide open banking transactions in under a second. (20)

As of November 2022, 114 Australian banks are sharing data with more than 30 different financial products.

They are separated as:

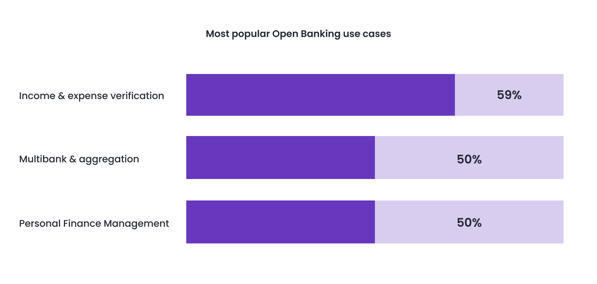

Frollo did a State of Open Banking report in Australia, and found that 92% of respondents intend to use open banking data, and 37% of businesses want to get started in the next 6 months. (3)

The most popular open banking use cases are:

Frollo also asked Australian finance industry professionals to participate in a survey. 78% of respondents said they were moderately or very familiar with open banking. 92% of respondents said they intend to use CDR data, and 37% intend to use it within the next 6 months. (3)

The top use cases for organisations are (3):

-

Income and expense verification.

-

Multibank aggregation.

-

Personal Finance Management.

-

Identity verification.

-

Credit scoring algorithms.

-

Account verification.

-

Product comparison.

-

Compliance.

-

Balance checks.

-

Transaction reconciliation.

-

Payee and direct debit switching.

You may also like: Why are Australian fintechs being de-banked and what can they do about it?

Payment fraud statistics

From June 2020 to June 2021, there were $490.1 million in fraudulent transactions on cards in Australia. (23) This presents as:

-

Card not present (CNP) fraud: increased by 12.3%.

-

Stolen fraud: down 9.2%.

-

Skimming fraud: down 37.3%.

-

Fraudulent application fraud: down by 56.3%.

-

Card never received fraud: down by 44.2%.

-

Other card fraud: down by 2.2%.

According to Auspaynet, the total fraud rate in 2021 was 57.8 cents per $1,000, up from 55.8 cents in 2020. (23)

Most of the fraudulent card transactions happened in Australia, and 92% were CNP transactions.

The total number of fraudulent CNP transactions is just 4% higher in Australia compared to overseas, however, the value lost to fraud is 56% higher in Australia when compared to other countries. (23)

The end of 2022 will be the third year that the industry’s CNP Fraud Mitigation Framework will be in action.

Losses caused by payment cards are projected to hit $49 billion in 2030 (24) according to the Global Payment Fraud report. Online sellers are predicted to lose $130 billion to online payment fraud between 2018 and 2023.

Card not present fraud is still the most popular type of fraud to overall credit card fraud. (24)

Device statistics

Australia has one of the highest use of POS devices in the world. In June 2021,

Australians used 940,000 POS devices across the country, in comparison with 26,000 ATMs.(22)

In 2021, the number of POS terminals in Australia increased by 5% to 941,291 in total, when it decreased in June 2020. (22)

Global payment statistics

Global cashless payment volume will increase by more than 80% from 2020 to 2025, and from 1 trillion transactions to almost 1.9 trillion, according to PwC. (25)

Asia Pacific is growing the fastest, with cashless transaction volume growing by 109% until 2025%. The next fastest growing regions are Africa, growing by 78%; Europe by 64%; Latin America by 52% and the US and Canada growing by 43%. (25)

Globally, the payments market grew from $551.87 billion in 2021 to $560.6 billion in 2022, at a compound annual growth rate of 9.5%. (26)

In terms of fraud, the increase in fraud is impacting the growth of the payments market globally. According to Merchant Savvy, losses from payment fraud tripled to $32.39 in 2020, and will be expected to continue to cost $40.62 billion in 2027. (27)

In 2021, global remittance flows to low and middle-income countries increased by 7.3% to $589 billion in 2021. The most common destinations for those remittances were in India, China, Mexico, the Philippines, and Egypt. (27)

.png?width=724&height=458&name=Methods%20for%20making%20cross-border%20payments%20(consumers).png)

According to Mastercard, 73% of consumers send money using an app, 46% send money via a website, and 30% send money in person. (27)

.png?width=822&height=434&name=Methods%20for%20cross-border%20payments%20(businesses).png)

Australia payment statistics: online payments are on the rise

These Australian payment statistics show the rapid growth of online payment services, mobile payments, and NPP payments.

We hope this summary of Australian payment statistics is useful and gives you better clarity of the landscape.

Looking for a payment partner to help you build custom payment workflows? Reach out to us to learn more about what we do.

This information is correct as of December 2022 This information is not to be relied on in making a decision with regard to an investment. We strongly recommend that you obtain independent financial advice before making any form of investment or significant financial transaction. This article is purely for general information purposes.

Sources:

-

https://www.nfcw.com/2022/10/03/379439/one-in-four-card-payments-in-australia-are-now-made-using-a-mobile-wallet/

-

https://www.jpmorgan.com/merchant-services/insights/reports/australia

-

https://sob23.frollo.com.au/

-

https://www.auspaynet.com.au/resources/device-statistics

-

https://www.auspaynet.com.au/resources/fraud-statistics/July-2021-June-2022

-

https://www.mordorintelligence.com/industry-reports/australia-payments-market

-

https://www.rba.gov.au/publications/annual-reports/psb/2021/the-evolving-payments-landscape.html#glance-1-1

-

https://www.statista.com/forecasts/1004188/payments-at-points-of-sale-by-type-in-australia

-

https://www.rba.gov.au/publications/annual-reports/psb/2022/the-evolving-retail-payments-landscape.html

-

https://www.commbank.com.au/articles/newsroom/2021/05/digital-wallets-contactless-soar.html

-

https://www.nfcw.com/2022/10/03/379439/one-in-four-card-payments-in-australia-are-now-made-using-a-mobile-wallet/

-

https://investors.marqeta.com/news-releases/news-release-details/marqeta-study-australians-lead-way-digital-payment-use-mobile

-

https://www.globaldata.com/card-payments-australia-rebound-grow-8-3-2021-forecasts-globaldata/

-

https://www.rba.gov.au/publications/bulletin/2021/mar/cash-demand-during-covid-19.html

-

https://www.ausbanking.org.au/insight/banking-by-the-numbers/

-

https://www.jpmorgan.com/merchant-services/insights/reports/australia

-

https://www.savings.com.au/credit-cards/by-the-numbers-australian-credit-and-debit-card-statistics

-

https://nppa.com.au/wp-content/uploads/2021/10/NPP-October-2021-Roadmap.pdf

-

https://thepaypers.com/expert-opinion/the-state-of-open-banking-in-australia-in-2021--1253611

-

https://www.fintechaustralia.org.au/49-of-banks-provide-open-banking-transactions-in-under-a-second/

-

https://frollo.com.au/open-banking/the-state-of-open-banking-2021/download-confirmation/

-

https://www.auspaynet.com.au/resources/device-statistics

-

https://www.auspaynet.com.au/resources/fraud-statistics/July-2021-June-2022

-

https://nilsonreport.com/upload/content_promo/NilsonReport_Issue1209.pdf

-

https://www.pwc.com/gx/en/industries/financial-services/publications/financial-services-in-2025/payments-in-2025.html

-

https://www.thebusinessresearchcompany.com/report/payments-global-market-report

-

https://www.businesswire.com/news/home/20220613005534/en/Global-Payments-Market-Report-2022---Compound-Annual-Growth-of-11-Forecast-with-Market-Set-to-Reach-870-Billion-in-2026---ResearchAndMarkets.com